If you have any comments about our articles you can email Richard Bowen, CPA

Counting the cost of taxes... In advance!

Big tax bill and no money

I have had countless encounters with small business owners that need to prepare their tax returns, near april 15 and later, that have been very suprised by the amount of money they owe to the IRS. Essentially, nearly half way through the next business year business owners are forced to scramble to find cash to pay for last years' taxes. Everytime I am faced with this situation I attempt to tell the clients how they can avoid this problem in the future. The article below discusses the issue, and provides simple answers as how you can avoid this problem by counting the cost of income taxes as a part of your business model.

No one likes to pay taxes!

It is a simple fact that no one has any money to pay the IRS when tax season comes around. People know that they are earning money, and making profit, but for some reason do not have a pile of money saved to pay the IRS. It is not actually that no one has any money, it is that people use their money for things that they think are important. Business owners reinvest in their businesses by hiring new staff, advertising more, and buying new equipment. Other taxpayers put money into their IRA's, buy material items and services to increase their quality of life, and save money in their nestegg. So it is not that there is no money around, it is that no one has any money to give away to the IRS.

The operative phrase here is 'give away'. When you have looked at the amount of money you have and must decide between having something you want, making life better for you or your family, or writing a check to the IRS the answer seems simple.

In this article I will help you learn how to 'Count the Cost' of taxes as part of your business model. Making it easier for you to know what money you can spend and what money belongs to the taxing authorities.

The purpose of owning a business

The main purpose of for profit businesses is to make money. Why do you want to make money? It is not soley to support the business, but to generate cash flow above and beyond the businesses operating expenses themselves, and use the excess to fund your personal finances. Often business owners combine and comingle their business and personal transactions to the point that it is difficult (without accounting software), when looking at their bank accounts, what thier business net profit is. If you put all of your money into one big pool and pay all of your business and personal expenses from that pool, commonly you will be left with zero dollars, and no idea what the tax due on the business income is. Proper seperation and allocation allows you to see if your business is making money, ensure that money is saved for taxes and that there is money left over to fund your personal budget. If the purpose of your business is to provide enough excess cash to fund your personal finances, then you do not want your business operations to leave you with all of your bills paid, but with a hefty debt to the taxing authorities. To avoid this scenario money needs to be allocated according to the proper priority.

Is it easier to be an employee?

When it comes to the issue of paying your income taxes it is much easier to be an employee than a business owner. Employees have an estimated amount of money withheld from their paychecks to go toward their income taxes. This happens before the employee even sees their check, and while they can see the deduction on their paystub, they never had the option of spending that money before it was sent to a taxing authority. The employer is the one doing this on the behalf of the employee, and they send the money to the IRS and FTB for them. At the end of the year the Employee gets a W2 showing all of the totals. The W2 is used to prepare the employees personal income tax return, and generally, they should not owe any tax as long as their tax situation is straighforward, and they have claimed the proper amount of dependents on their W4 form.

Business owners have to estimate the amount of taxable income they are going to have (usually with the help of a CPA), and make quarterly payments to the IRS and FTB on their own behalf. In between making payments they have a lot of cash floating around in their bank accounts just waiting to be sent off. They are responsible for having estimates prepared, adjusting them according to what actually happens during the year, sending payments, and then reconciling these payments using their tax return at the end of the year. Generally, the business owner uses a CPA to aid them in this process which costs money.

Business owners process is significantly more complicated that being an employee. There are a lot of advantages to being self employed, and while it seems like all of the items I just mentioned may not be advantages, I hope I will change your mind as we continue.

It is a matter of perspective

Business owners have a much more complicated tax scenario than the average employee. The reason for this is that they have a lot more deductions tax advantages available to them. Employees generally cannot use mileage deductions, depreciation, or the accrual basis when preparing their income tax returns. The business owner has these options available to them, but the cost of these advantages is the additional paperwork and coordination of the records and payments. It is a tradeoff that can benefit the business owner much more if they look at it with the proper perspective.

Most business owners focus on generating income, then paying their business expenses, then paying thier personal expenses, or some combination of these three items. The one thing missing is the payment of taxes. The formula should look like this business income minus business expenses equals taxable income, then calculate and pay income taxes, then the remaining is available to the business owner for personal expenses.

If you do not have a bunch of money floating around in your bank accounts to pay the taxes then you are either losing money, or you have not figured the cost of taxes into your business model. Figuring taxes into your business model is the main goal of this article. If you are losing money you don't need to worry about paying the taxes because you do not owe any (the tax due on a negative number is 0). If you are spending your quarterly tax payment money on business or personal expenses then you have a problem spending and saving your money according to priority, and will likely have problems come tax time.

The key to having the money to send into the taxing authorities when it is due, is to count the cost of the money as part of your business model. What does this mean? Instead of thinking of the gross dollars your business earns as being 100% available to you, you must only expect to keep a percentage of it. This is very similar to the way that an employee knows they will not get 100% of the dollars per hour that they earn. This is the perspective that every business owner needs to have so that saving, and later paying the income tax money is not difficult.

Fixing your business model

Fixing your business model is as easy as replacing your current model with the one below. I have included some numbers as an example.

| Business Income (gross income) | 500,000 |

| - Business Expenses | -325,000 |

| = Net Before Tax Profit | 125,000 |

| ------------------------------------------ | ------------------ |

| Calculate Tax by percentage (conservatively using 25%) | |

| - Taxes (which will be held in a savings account until they are due) | -31,250 |

| = Net Business Profit | 93,750 |

| Net Profit Percentage | 18.75% |

What does this mean? It means that of every $100 of income that your company earns $18.75 is available to you for use in you personal budget. The idea of the business model is to list the income you expect to make, and anticipate the expenses related to generating that income (create a budget for your company). If you can do these two things then you can properly estimate your taxes, which will allow you to estimate how much money from your company is available for your personal finances. After all, generally the point of having is a business is to generate income that can be used to fund your personal finances.

By counting the cost of the taxes as a part of your business model it allows you to easily know how much money needs to be spent on business expenses, saved for taxes, and how much you can use to fund your personal budget. If you allocate the money accordingly, and track your performance you should not have a problem paying your taxes, keeping your business running smoothly, and have tax free money available for use in your personal budget. In essence, you are counting that tax money upfront as a part of doing business before you get your personal finances involved.

The business account is the gatekeeper

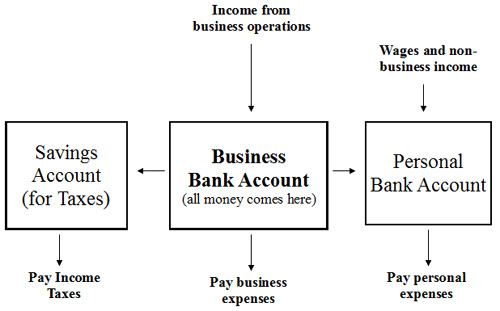

Having the proper bank accounts is very important when trying to keep business money, allocated tax money, and personal money seperate. The following diagram shows, what accounts you should have and how the money should flow between them.

Using percentages from the example in the business model above, every time you cash a $100 check you put $6.25 (31,250 taxes / 500,000 gross income) in a seperate account (savings account) to cover the income taxes, and transfer $18.75 (net profit percentage) to your personal account, everything else should be left in the business account for operating capital. If you find that the business account has a growing account balance, that means that you are earning more or spending less in relation to the business than you expected, and you need to adjust your tax estimates. Note that the business account, and transfers to personal accounts are providing a basic profit and loss model. By looking at how much cash you have in the business account plus how much money you have tranferred to your personal account you can easily figure out what your basic net profit on your business is without using fancy accounting software.

By transfering the correct percentages to the proper accounts when the money is received it allows you to operate your business, and spend your personal money with piece of mind, knowing that your business expenses are covered, your taxes are paid, and that the money you are spending on personal expenses is free and clear of encumbrances. Essentially, you have counted, or folded, the cost of income taxes into your business model. This means that you can spend every dollar in your personal account on personal expenses and not have to worry about any additional tax implications. All of the money in your accounts is now tax free and available for spending, investing and saving.

Thinking about starting a business?

If you are thinking about starting a business, it is important to include the concepts above as your key financial planning concept. Many entreuprenuers that want to start a business overlook, or do very limited financial planning, and most that do financial planning commonly overlook the income tax aspect. It is important to count the cost of income taxes as a cost of doing business, and thus it should be examined fully.

No one sets out to start a business on shaky footing, but often the excitement of being your own boss or getting paid to do what you love gets in the way of good planning. Take your time, setup the proper bank accounts, provide proper seperation between your business and your personal finances and enjoy the benefits.

Some Notes:

The business model example is just that, a loose general idea of the percentages used by companies that I have seen. They do not represent the numbers that will be used in your actual business. In the case of the business expense line, you would actually have several lines listing all of your business expenses (insurance, salaries, rent, ect...) to arrive at a total expense line. As for the tax withholding percentage of 25%, this number is generally pretty safe depending on your net before tax profit. You should sit down with a CPA after you have put together your actual budget to make sure this withholding number works for your business.

No matter how big or small your business venture is, every business owner can benefit from the help of a skilled accountant and tax preparer. If you are thinking of starting a business or have had problems coming up with enough cash to pay your taxes please invest the money that it takes to seek good advice from a professional. Bowen Accounting provides free estimate and budgetting services to most of it clients, and reasonably priced services to larger businesses.

Considering the tax implications of your business operations is very important because you do not want to owe money to the IRS or FTB. It is very difficult to get out from under an IRS debt. If you are spending all of your business profits, and not paying the tax, the cost of cleaning this problem up is very high. IRS debts cannot be bankrupted and penalties and interest can be as much as an additional 1/3 of the total tax debt.

Owning a business makes your budget significantly more complicated. In a normal budget income is expressed on one or two lines, when you have a business income is derived from first calculating business net before tax profit, then subtracting taxes. If you are interested in budgetting please read the 'How to get out of debt... Spend less than you make' article, which has a full section on how to create a personal budget, and then contact us for additional resources to help you add your business to the top of the budgetting process.